6 Tips To Improve Your Credit Score When Buying A Home in Buffalo

Summer is just about in full swing, and with the warmer temperatures, we have many home shoppers outside in Western New York looking to buy a house.

Inflation has caused a sharp increase in many things throughout New York State. From gasoline and fuel to chicken wings, the cost of goods and services has been increasing exponentially. Those increases also include housing.

According to a report issued by the Buffalo Niagara Association of Realtors, the median home sales price in the Buffalo area has increased by more than 65% since March 2020. Before the COVID-19 Pandemic, the average house in Western New York sold for $171,140, in May 2022 that average sales price has soared to $275,217.

Those large price increases have made it especially difficult for people to make a home purchase, especially First Time Homebuyers who may not have as much available cash to spend more than their budget.

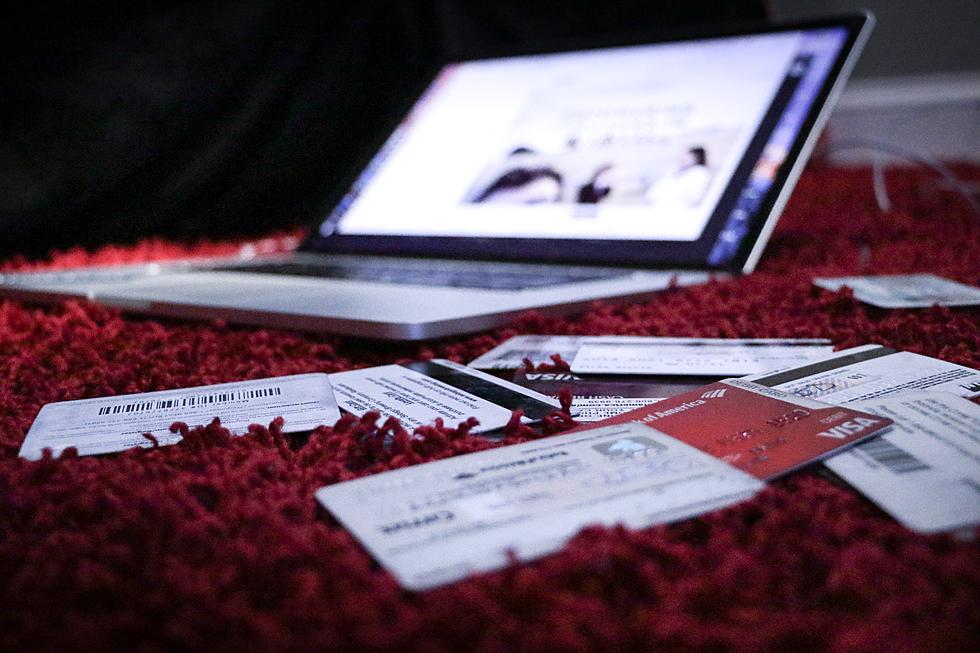

That's why making sure your credit is as good as it can be is super important. Here are a few tips to help make sure your credit is in tip-top shape:

Try To Keep Your Credit Utilization To 30% Or Less

Your credit utilization, or the amount of credit you have used compared to how much credit you have available, is a key indicator for credit grantors about how healthy your finances are. Try to keep that amount below 30%, i.e. if you have $10,000 in available credit, don't spend more than $3,000.

Pay Your Bills On Time, Every Time

According to FICO, your payment history makes up the largest percentage of your credit score. Just paying your bills on time will go a long way to helping you have great credit.

Closing Accounts Can Lower Your Score

If you have an unused account, it might make more sense to keep the account open. Closing old accounts may cause you to have less credit available to you, which in turn may increase your utilization, and higher utilization can equal a lower score.

Not Using Credit Isn't Necessarily A Good Thing

Not using a lot of credit, or having a thin file, means the credit granting agencies don't have a lot of history to judge your creditworthiness, which may also mean a lower credit score.

Try To Pay Off Your Revolving Debt Before Installment Debt

Your revolving debt like credit cards and lines of credit typically have a higher interest rate than installment debt like car loans, so when reviewing your credit plan, shoot to pay down the higher interest debt first.

Check your Credit Report Often

According to the Consumer Finance Protection Bureau, it's estimated that more than 30% of people have errors on their credit report. Checking your credit report often can ensure that your report is accurate and that will help you with your credit score.

Thanks to changes made by the Federal Trade Commission every American can check their credit report for free on a weekly basis through the end of 2022. Don't be caught off guard because knowing is half the battle.

5 Most Expensive Houses For Sale in WNY

The Ultimate 2022 Buffalo Summer Camp Guide

Meet the 9 Black Billionaires in America, Members of a Rare Club

More From 92.9 WBUF